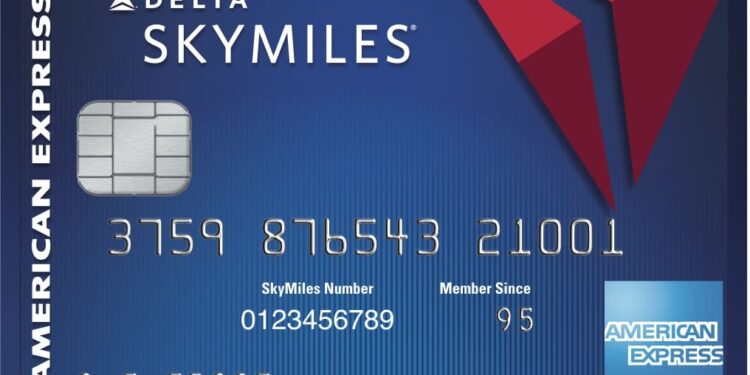

After over 14 years of traveling the world, I’ve lost count of how many free flights and upgrades I’ve had. Thanks to travel hacking, I’ve been able to enjoy free flights, free hotel stays, upgrades, lounge access, and more — all without any extra spending.

This Article is Free for Subscribers

Access 2000+ premium insights, visa updates, and global lifestyle stories all in one place. <div> For Subscribers, Login here

Login if you have purchased