International Student Budget in Canada to Increase in 2024

In a recent announcement by Immigration Refugees Citizenship Canada (IRCC), there has been a significant increase in the cost-of-living requirement for international students applying for study permits. Starting January 1st, 2024, single applicants will need to demonstrate $20,635 CAD in readily available funds in addition to their first-year tuition and travel costs. This represents more than a double increase from the previous requirement of $10,000 CAD, which had remained stagnant since the early 2000s.

IRCC cited the rising average living costs for international students in Canada as the reason for the adjustment. The previous requirement, they explained, was no longer sufficient to meet students’ basic needs and often left them financially vulnerable. This change aims to ensure that international students arrive in Canada with sufficient financial resources to cover their expenses for international students in Canada and avoid exploitation.

Student visa financial requirements in Canada have been updated to reflect this change. The new Canada study permit financial criteria now includes the increased cost-of-living requirement, and it will be adjusted annually based on Statistics Canada’s low-income cut-off (LICO). This ensures that the Canada study permit’s monetary requirements remain aligned with the actual living expenses for international students.

Our Student Advice team have prepared a detailed guide to help you understand the reasons behind the changes in financial requirements for study permits and practical tips for budgeting and planning for these expenses.

Rising Accommodation Costs

One of the biggest expenses for international students in Canada is accommodation, which has spiked sharply over the past decade. Various types of accommodation are available, including on-campus dormitories, off-campus apartments, and homestays. The average cost of accommodation varies depending on the city, with major cities like Toronto and Vancouver being more expensive than smaller cities like Halifax and Saskatoon. On average, students can expect to pay between $600 and $1,500 per month for accommodation.

Here’s a breakdown of the different types of accommodation and their average costs:

On-campus housing:

- Typically, it is the most expensive option, ranging from $1,000 to $1,500 per month.

- Offers convenience and access to campus facilities and amenities.

- Often includes meals and utilities in the rent.

Off-campus housing:

- More affordable than on-campus housing, ranging from $600 to $1,200 per month.

- It requires more effort to find and secure.

- It may require additional costs for utilities and internet.

Homestays:

- Homestays are a unique opportunity to live with a Canadian family and experience Canadian culture firsthand.

- Costs vary depending on the family and the location but generally range from $700 to $900 per month.

- Includes meals and utilities.

Additional expenses related to accommodation:

- Internet: $50-$70 per month.

- Utilities (if not included in rent): $50-$100 per month.

- Moving costs: $100-$200.

- Furnishing (if necessary): $100-$500.

To find affordable accommodation, students can consider sharing an apartment with roommates, living further away from campus, or looking for rental listings on websites like Craigslist or Kijiji. It’s important to also factor in additional costs associated with accommodation, such as utilities, internet, and furniture.

Food and Grocery Costs

Another significant expense for international students is food and groceries. The average cost of groceries in Canada is around $200 to $300 per month, depending on dietary preferences and location. Eating out can be more expensive, with the average meal at a mid-range restaurant costing around $15 to $25.

To save money on food and groceries, students can consider cooking at home, buying in bulk, and shopping at discount grocery stores like No Frills or Walmart. It’s also important to factor in additional costs associated with food and groceries, such as dining out with friends or buying snacks on campus.

Transportation Costs

Public transportation is a convenient and affordable option for international students in Canada. Major cities have extensive public transportation networks, including buses, subways, and streetcars. The average cost of transportation varies depending on the city, with monthly passes ranging from $100 to $150.

Additional benefits of using public transportation:

- Reduced environmental impact: Buses and trains emit significantly less greenhouse gases than cars, making them a more environmentally friendly way to travel.

- Increased safety: Public transportation systems are typically well-maintained and safe, reducing the risk of accidents.

- More time to relax or study: You can use your commute time to read, study, or listen to music, maximizing your productivity.

Students should consider public transportation as a key component of their international student budget in Canada, budgeting around $100-$150 per month for transportation expenses. This will allow them to factor it into their average living costs for international students and expenses for international students in Canada.

International students can consult their university websites or local transportation authorities for detailed information on public transportation options in specific cities.

To save money on transportation, students can consider walking or biking to campus, carpooling with friends, or taking advantage of student discounts on public transportation. It’s important to also factor in additional costs associated with transportation, such as parking fees or occasional taxi rides.

Health Insurance Costs

International students in Canada must have health insurance, either through a private insurance provider or their school’s health plan. The average cost of health insurance for international students is around $600 to $800 per year.

Staying Healthy: Health Insurance for International Students in Canada

International students in Canada are required to have health insurance to cover any medical expenses they may incur during their studies. This requirement ensures that students receive necessary medical care without facing financial hardship. Students can choose to purchase health insurance through a private provider or enrol in their school’s health plan. The average cost of health insurance for international students ranges from $600 to $800 per year.

Here’s what you need to know about health insurance for international students in Canada:

- Types of coverage:

- Private insurance: Offers a wider range of coverage options and may be cheaper depending on your age and health.

- School health plan: Typically more affordable but may have limited coverage.

- Essential benefits:

- Hospitalization

- Physician visits

- Prescription drugs

- Diagnostic tests

- Emergency medical services

- Additional coverage options:

- Dental care

- Vision care

- Mental health services

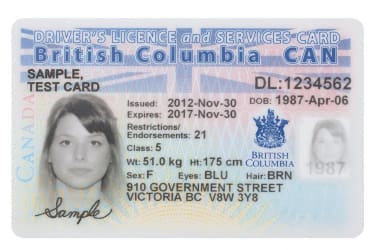

- Proof of insurance:

- Required to obtain a study permit and to register for classes at most universities.

- Can be submitted in the form of an insurance certificate or a letter from your insurance provider.

Budgeting for health insurance:

Include the cost of health insurance in your international student budget in Canada alongside other average living costs and expenses for international students in Canada.

To find affordable health insurance, students can compare different insurance providers and plans, and consider opting for a higher deductible or a lower coverage limit. It’s important to also factor in additional costs associated with healthcare, such as prescription medications or dental care.

Miscellaneous Costs

There are various other costs associated with studying in Canada, such as textbooks, school supplies, and entertainment. The average cost of miscellaneous expenses varies depending on the student’s lifestyle and location, but can range from $500 to $1,000 per year. This range can help you plan and allocate your finances accordingly.

Here are some tips for managing your miscellaneous expenses:

Textbooks and Supplies:

- Rent or borrow textbooks: This can save you significant money compared to buying new copies.

- Look for used books: Online platforms and campus bookstores often offer used textbooks at discounted prices.

- Purchase digital versions: E-books can be cheaper and more portable than traditional textbooks.

- Utilize library resources: Many libraries offer access to textbooks and other academic materials.

Entertainment:

- Explore free activities: Take advantage of free events and attractions offered by your city or university.

- Cook at home: Eating out can be expensive. Cooking your own meals is a healthier and more affordable option.

- Join student clubs and organizations: These activities provide social interaction and entertainment at minimal cost.

Personal Care:

- Plan your purchases: Bulk buying groceries and personal care items can save you money.

- Look for deals and coupons: Many stores offer discounts for students, so be sure to take advantage.

- Utilize student discounts: Many businesses offer student discounts on products and services.

You can manage your miscellaneous expenses effectively by being mindful of your spending and exploring budget-friendly options. Remember to factor these costs into your international student budget in Canada to ensure you have the financial resources to cover your living expenses for international students. This will help you comply with the Canada study permit financial criteria and meet the proof of funds for study permit requirements set by Immigration, Refugees and Citizenship Canada (IRCC).

It’s important to also factor in additional costs associated with miscellaneous expenses, such as travel expenses for visiting family or attending conferences.

Conclusion

Understanding the comprehensive cost of living requirements for Canada study permit applicants is crucial for prospective students and their families. By budgeting, working and planning for these expenses, students can ensure a successful and enjoyable experience studying in Canada. It’s important to consider all the expenses associated with studying in Canada, including accommodation, food and groceries, transportation, health insurance, and miscellaneous costs.